- Home>

- Uncategorized>

- How the software industry will change when development cost nears zero (who will still make money?)

With the advent of AI-assisted development, the cost of developing software is quickly going down. Will this make software free in the future?

To answer this question, we need to look at the microeconomics of how market price is set.

In traditional microeconomic theory, the cost of producing an additional unit for a company generally follows a U-shaped curve. For any individual producer, the cost of each additional unit produced increases after a certain threshold, making it challenging to exceed production beyond a specific level without incurring costs higher than the market price.

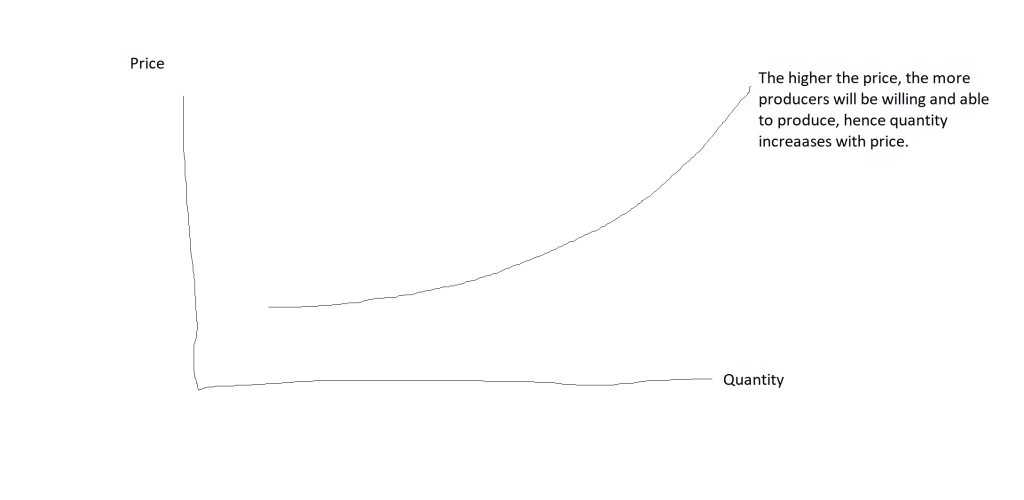

As a result of this, at a given price, any producer is willing to produce a certain amount of units. Because of this, the amount of supply (i.e. the supply curve) increases with price, and at some point crosses the demand curve, leading to the market price.

I won’t go into more detail about this since this is well known microeconomic theory.

What I couldn’t find any established theory around, though, is how this works when the cost curve doesn’t actually go up, but down, with each additional unit produced – i.e. the software industry.

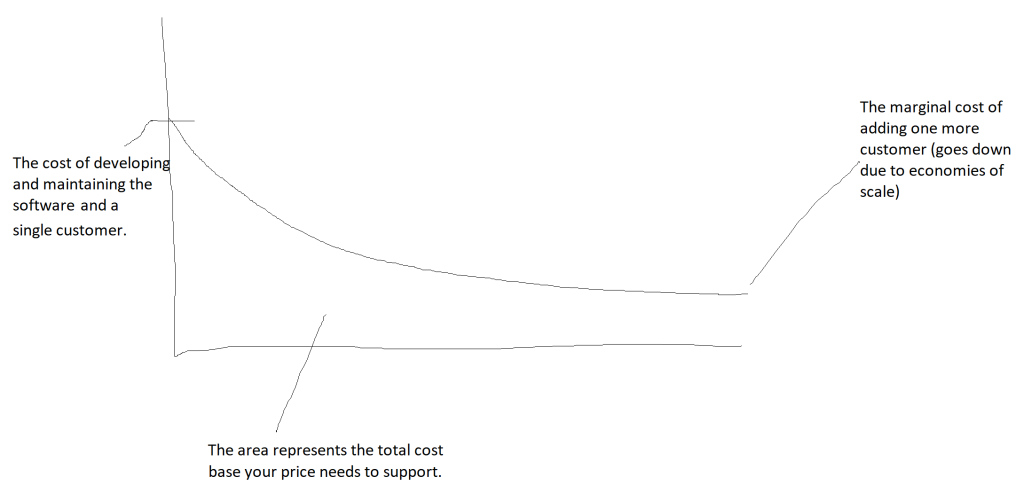

The key difference with software is that the cost of producing an additional unit always goes down. Thus, once a producer enters a market, they can supply the entire market (assuming that their software is scalable). An individual producer’s cost/quantity curve looks like this:

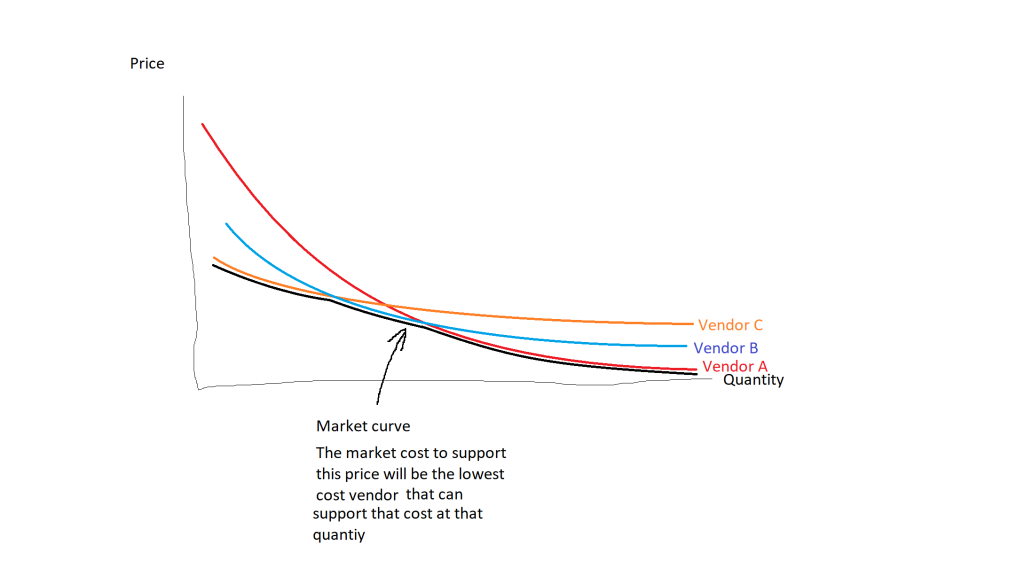

This means that rather than multiple vendors being needed to support the full demand, a single vendor can actually support the entire market demand. The one who will win is the one vendor who can support the entire market at the lowest total cost. Their total cost basis divided by the total number of customers will be the price setter.

The market price/supply curve will look something like this:

Thus, if you can build a software that is scalable enough to support the entire market efficiently, you will win the entire market (if you can get there, that is, which requires heavy upfront investment). This is why the silicon valley model is to pump in enormous investments in software based on market predictions hoping to reap the large rewards later on.

In this winner takes all market, who can be profitable? There are three categories:

This is why the software industry is riddled with small copycats, differentiated niche players, and huge mass-market “all in one” players. Here’s the interesting predictions of how these dynamics will work:

This is exactly what we’re seeing in the market today. A proliferation of various software, some without real differentiation but “lower quality and lower cost” (but good enough for the low end customers who choose to make the trade-off due to lower budget), and an huge and growing number of niche players.

First we have to understand what drives the total cost of maintaining a customer base with a software solution. That’s when we can understand the real effect when of one of those cost drivers (software development costs) goes down or even disappears.

The total cost basis of a software vendor consists of:

This equation looks different for the niche players, copycats, and the dominant player, relatively speaking.

The dominant player’s relatively higher costs will be marketing and scalability.

The copy cats’ relatively higher costs will be developing and supporting customers.

The niche players’ relatively higher costs will be marketing and developing.

But only developing and supporting customers will become cheaper with AI. It will be easy to throw together new software and adding new features. And AI will make support easy with automated chat bots who help customers find answers to their problems. But marketing still requires deep original research into customers’ needs, and to actually be seen. And physical infrastructure will still cost as much, with or without AI.

So let’s analyze what the resulting outcome will be for each type of player in this table:

| Category | Relatively most significant costs today | Resulting outcome | Relatively most significant costs in the future |

| Dominator | Marketing Scalability | The dominant players will still be price setters and the price of scaling will remain. | Marketing Scalability |

| Copy cat | Developing Supporting | The market will be flooded with low-quality copy cats who become buggy as soon as they become popular. | Supporting Scalability |

| Niche player | Marketing Developing | The market will be flooded with niche players who target smaller and smaller niches, but few will manage to own their respective markets due to prohibitive marketing costs (finding a niche with a particular segment of a particular job to be done, then reaching that market). | Marketing |

In other words, costs will not disappear! The main limiting costs will shift in some cases, but just because software development costs disappear, it doesn’t mean that it will be virtually free to support a large customer base.

It will be easier for copy-cats to enter the market, but just as difficult to scale. And the same goes for niche players, only for different reasons (marketing, in this case “finding a specific segment within a particular job to be done”) is expensive and hard, hence the market will find a plethora of smaller and smaller niche players (easy to enter) who never dominate any particular niche (still hard to nail the niche’s job outcomes and capturing the full niche)

As the cost of software development continues to go down, it will be possible to serve smaller and smaller niches. If we take it to its tail end, it may become cheaper to develop a new software from scratch for a single company, than to do market research and find a niche for which you can serve the same software.

Hence, we’ll see the rise of “software development agencies”. For example, when you need a “crm software”, you may opt to hire an agency to just throw one up for you, rather than researching the market and finding the best one. It may be so cheap to develop software that it costs less to develop one from scratch than to research and test which one fits you best.

But it will not go down to zero. The limiting costs for these software development agencies will be the cost of supporting each customer, and a new type of cost we haven’t covered before: the cost of understanding the customer’s needs (i.e. customization cost). These will not be lower than the dominant player’s cost. So these can be seen as niche players, only that they’re serving a niche of a single customer who value a fully customized software at a higher cost than purchasing the dominant player’s software.

Therefore, software development agencies will steal customers mainly from the smallest niche players. They are vulnerable because the cost of marketing to a small enough niche will be higher than the cost of just developing a unique software for a particular customer within that niche.

To lower their customization cost, the Software Development Agencies will evolve into “module customizers” – i.e. they will target a “market” with fully customizable modules that they can throw together into a coherent, unique software really quickly. It may even go as far as a new type of software developer, who doesn’t really develop software, but actually just provides “modules” that customers can puzzle together into a software based on courses and best practices themselves (i.e. Software Development Module Kits). Either option will allow the “one software per customer”, while lowering the customization cost, because by having ready-made modules based on best practices, you can recommend what typically works for each customer, rather than needing to deeply understand a customer’s needs. The resulting outcome is Software Development Agencies and Software Development Module Kits who target particular niches. These will operate under the same business model as today’s agencies – essentially doing retainer-based work for individual customers within a certain niche, and having expertise in that niche.

The dominant scale players will continue to exist safely, although their market share will be somewhat eaten by the gazillion niche-focused software development agencies, -kits, copy cats and niche players out there.

Copy cats will struggle. It will be even easier to create a copy cat and they will have a harder time to reach a larger market share. Those who do will continue to be littered with low quality.

Niche players will lose market share to niche-focused software development agencies and -kits, but the ones focused on larger niches will survive and thrive if they can build a moat.

And finally, the market will be filled with new Software Development Agencies and -Kits. The structure of this market will look very similar to today’s general agency market (for example any type of marketing agency). They will be more service companies than software companies, but some will “productify” their software and grow large (niche-focused ones who develop “modules” and “best practices” to base their software on), just like today’s marketing agencies.

The end result is a market consisting of the following players:

Yes. But with some differences compared to today:

Yusuf runs a Swedish CRM and Marketing Automation software vendor, FunnelBud. Follow Yusuf on LinkedIn or by subscribing to FunnelBud’s newsletters at https://www.funnelbud.com/.

[…] How the software industry will change when development cost nears zero (who will still make money?) […]